Roberta Sandberg Tax Services

In general everyone, regardless of if they file their taxes themselves or file through a tax advisor, want their tax return completed correctly to avoid any issues later on. When tax season comes around, it can prove to be a stressful time for some people especially if faced with a complicated tax return that has many different deductions. Consulting with a tax advisor can assure people that their tax return will be filed correctly and on time.

Background:

Roberta Sandberg currently has a small business that offers tax and accounting services. With 35 years of accounting experience, including 27 years of tax preparation, Roberta offers tax preparation for individuals, small estates & trusts and sole proprietors and is a certified agent able to help clients follow up with the IRS if necessary.

Problem:

My client Roberta Sandberg wants a responsive website that will help her draw in new clients to her tax preparation/accounting business and provide an outlet for clients that are looking for tax information and other accounting services.

Solution:

To create a website will introduce new clients to the services that Roberta Sandberg provides as well as tax information/resources and downloadable forms for new and existing clients. This website will include information to contact Roberta Sandberg with any questions and will give clients an option to schedule a date/time for an in person appointment.

Goals:

To create a website that is easily usable for new and current clients to contact Roberta regarding services as well as research tax information and download necessary forms. Some features will include:

Detailed information about what services Roberta provides

Ability for clients to request/schedule an in person appointment with Roberta

List of documents that clients will need to bring with them for a tax appointment with Roberta

Ability for clients to request/schedule a phone call with Roberta

Detailed tax information

Downloadable forms for tax clients

Links to IRS.gov for more tax information

User Research

Objectives I hope to determine in my user research:

Determine if clients have a tax advisor assisting them with filing their taxes. If not, why not?

Determine what features/attributes draw a client to seek assistance from a new advisor.

Determine what information/forms clients would like to have access to when preparing to file their taxes.

Determine the best way to request/schedule an appointment or phone call with a tax advisor.

Market Research/Competitive Analysis:

Competitive analysis is defined as the process of categorizing and evaluating your competitors to understand their strengths and weaknesses in comparison to your own. I am using competitive analysis to research features of other tax/accounting sites and find out what works well and what doesn’t.

I am also using market research to determine design patterns in the scheduling feature, information sections and other features.

Conclusion:

All of the tax and accounting websites that I reviewed had a resource area that included informational articles, some including other resources such as videos, helpful tax tools and links to other pertinent websites

Half of the sites included an area to request/schedule an appointment. They both used a fill in form that the user would enter in name, email, subject and time/date

All reviewed websites use fill in forms to contact/send an email to the business

Some of the helpful tax tools I found over the websites include:

Tax prep checklist

Tax calculators

Links to find W2, IRS and Illinois Dept of Revenue

A helpful feature that was found on one of the websites was the secure portal, password protected way for the tax advisor and client to exchange documents and other secure information

User Interviews:

To better understand the needs of people regarding filing their tax returns, I conducted user interviews with 4 participants, including different filing statuses…2 filing single, 1 filing married, joint and 1 filing married, separate.

Several key findings were determined:

There are 2 types of people when it comes to filing their taxes, people that file their tax return themselves and people that have another person file for them whether it be a family member/friend or a tax advisor.

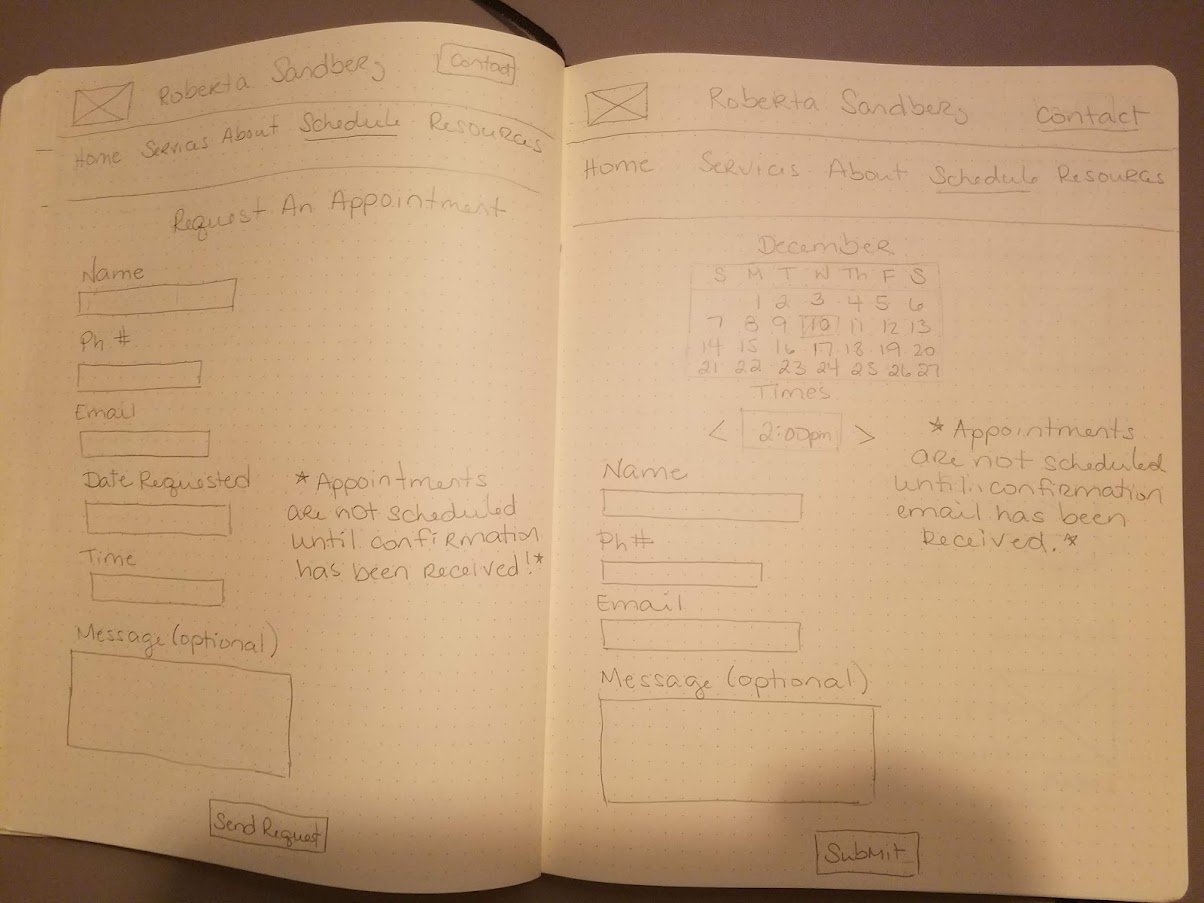

There is a desire when using a tax advisor to be able to schedule and/or see the dates/times that a tax advisor is available on their website.

There is a desire to have access to a number of tax resources in one location:

Downloadable forms used for filing

Checklists

Everything that you would need to file taxes

What you would need to bring to your appointment with a tax advisor

List of deductions a filer can claim

Links to IRS website

Creating Solutions

Defining the target audience:

New clients looking for help with tax returns and other accounting needs

Existing clients wanting to schedule their yearly appointment with Roberta to go over their tax information

Anyone looking for tax information and downloadable forms

Empathy Map

How Might We Statements:

How might we make scheduling appointments with Roberta easier for both new and current clients?

How might we make the appointment itself easier for new and current clients?

How might we draw in new clients for Roberta?

How might we make self filing easier for possible future clients?

How might we make site functions more accessible for current clients?

Personas

Features:

This tax advisor site has to be organized so that the user can quickly and easily locate the information that they are searching for, whether it be the services offered, tax resources like downloadable forms and checklists, or where they can request to schedule an appointment with Roberta.

I also worked through a site map to help determine the best navigational flow of the site for the user to best be able to locate information quickly.

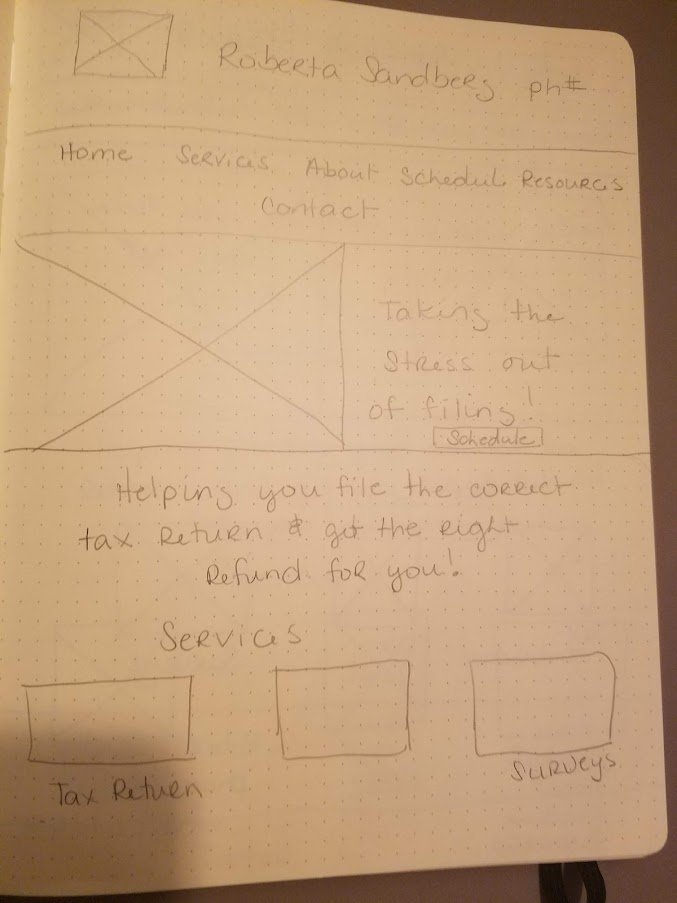

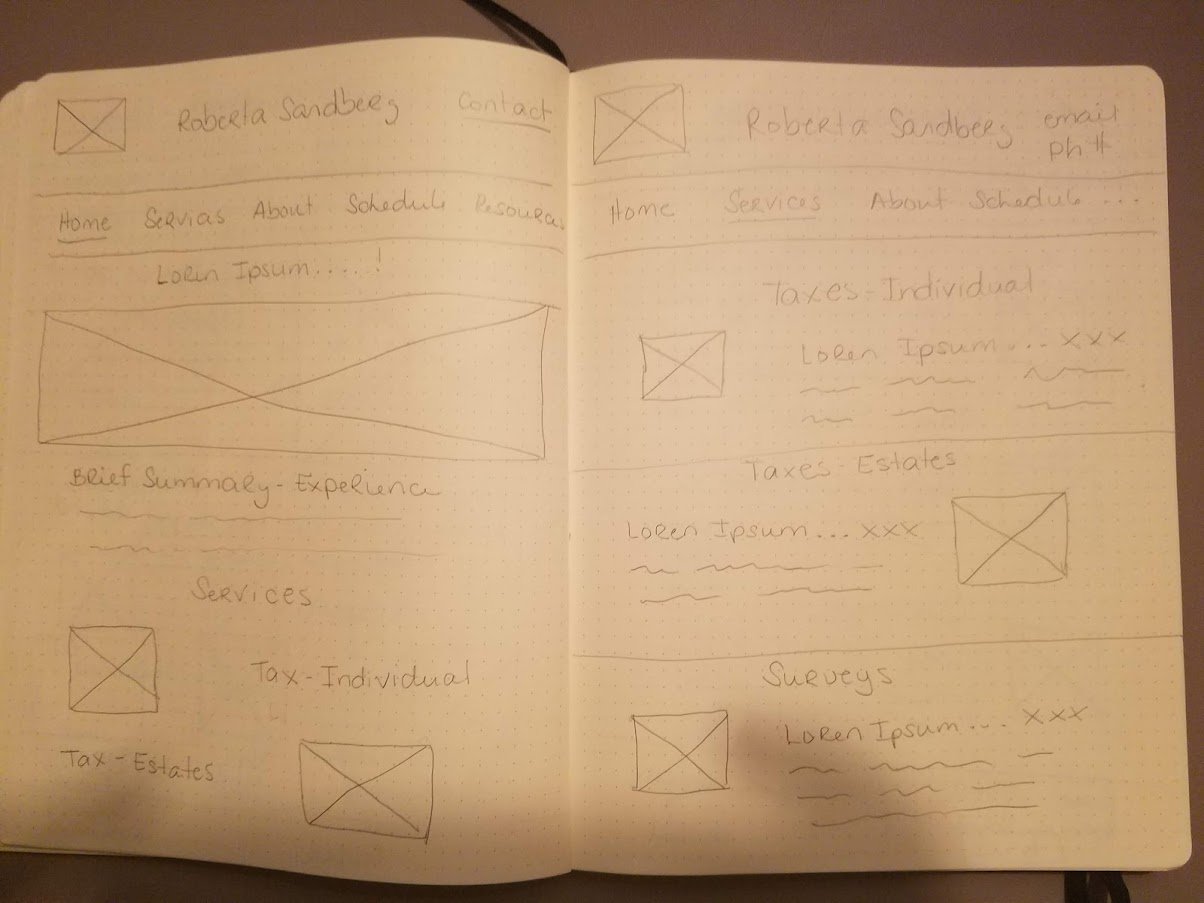

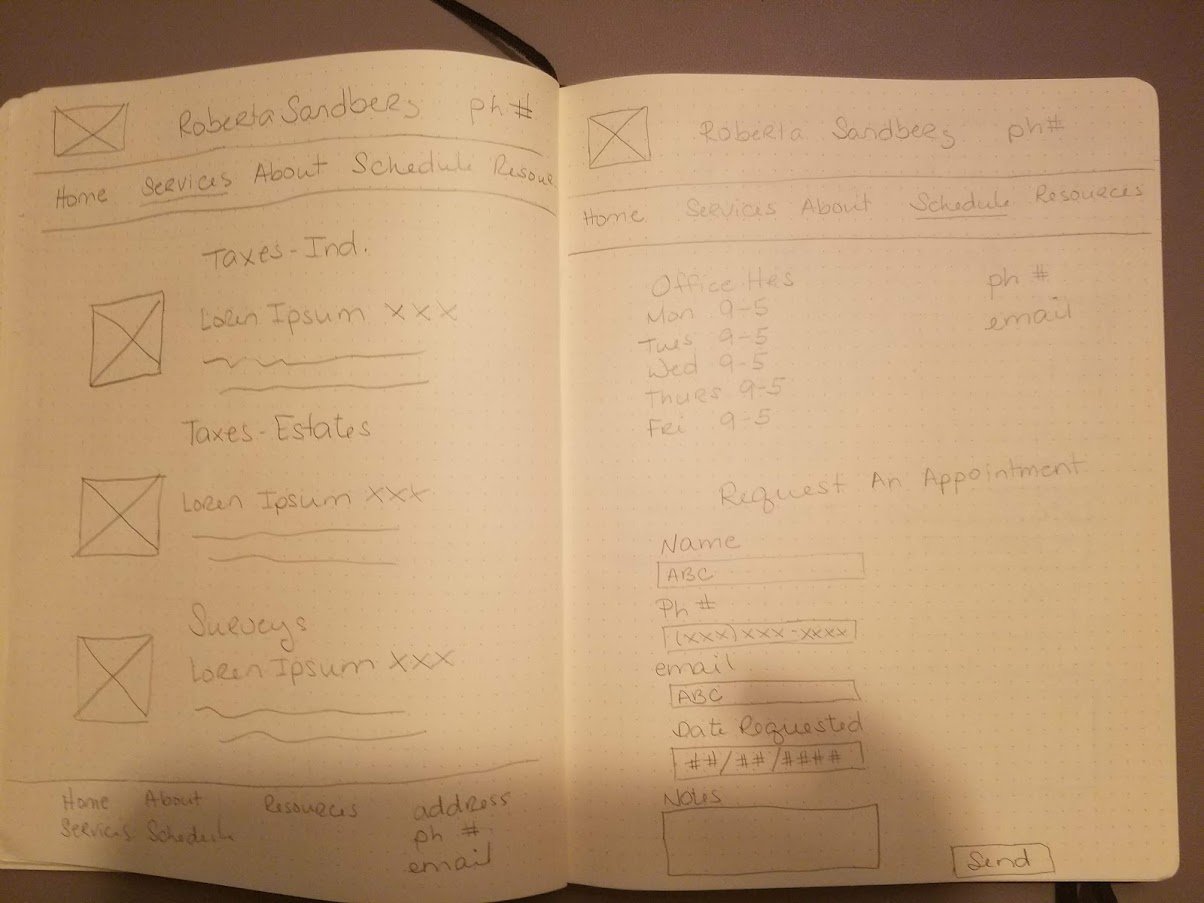

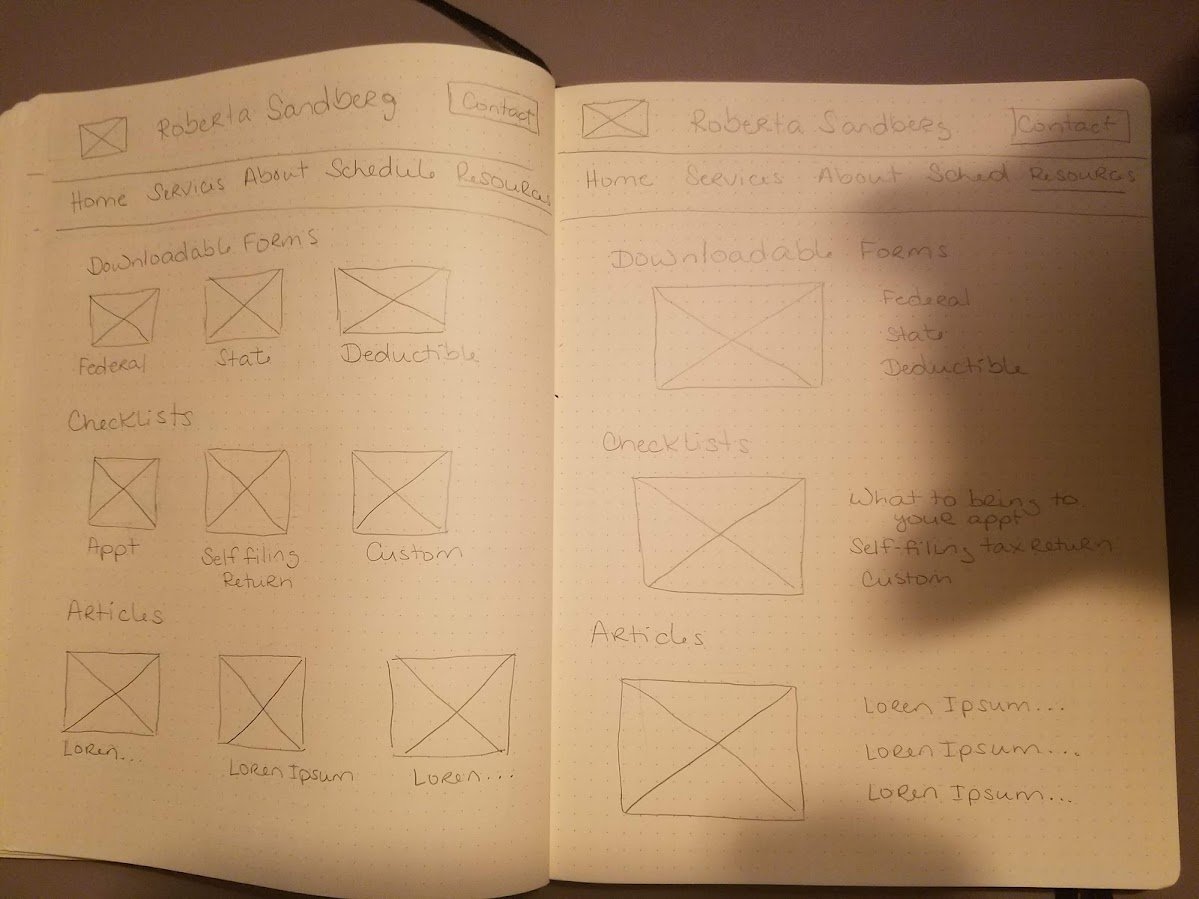

Sketches

User need #1

For a possible new client to review the services offered by Roberta and her experience to determine if they would like schedule an appointment.

Solution:

List a quick view of the services offered on the home page, with a connection to a services page that outlines each service in more detail.

Create an About page that lists all of Roberta’s experience and any certifications that she currently holds.

User need #2

For a current client to be able to send a request to schedule an appointment with Roberta.

Solution:

Schedule page including date and time the client would like to request and form fields for the client to enter all contact information and an optional additional message.

Usability Testing:

My main goal for this usability test is to understand how users react to/interact with the tax advisor website and make any changes needed to make the tax advisor website easy for users to navigate and utilize based on the testing results.

With this test, I want to determine:

If this tax advisor website is easy for the user to navigate (complete tasks) with little to no instruction

If the tax advisor website fulfills the new clients need to be able to make an informed decision about choosing a tax advisor and scheduling a first time appointment

If the tax advisor website fulfills the existing clients need to schedule an in person appointment with Roberta

If there are any elements missing from the tax advisor website that would improve user experience

To complete the usability testing, I used low fidelity wireframes and worked with 4 participants, including 3 participants that use a tax advisor to file their taxes and 1 that does not. All of the participants have different filing status and different reasons for using a tax advisor or self filing their return.

Test Findings:

The participants found the site to be easy to navigate and to locate the information that they were looking for quickly. They liked the documents/information currently listed on the Resources page, in one convenient location. They also found the scheduling page a good way to request an appointment for their tax filing, but did state they would like Roberta’s current available hours to be listed as well.

Next steps:

Next steps for this site would include building out the Resources page to include more tax information for Roberta’s clients and potential clients. This would include articles about tax updates, new procedures and articles about self filing. I would also add more tax tools like a tax calculator to estimate possible refund amounts.

Working with a client that owns a small business is rewarding, helping to grow their small business and putting their ideas about their first website into a reality. The main thing that I took away from this experience is to communicate with the client throughout the process to find out their ideas, and trust in your abilities to create a product that best fits the client and their brand.